Introduction to Nordic Underwriting

Nordic Underwriting provides underwriting (guarantees) in connection with preemptive rights issues on the Spotlight and Nasdaq First North Growth Market stock exchanges in Sweden and Denmark.

Nordic Underwriting may, in special cases, also participate in transactions that take place on the main markets in these two countries. Our guarantees typically range from SEK 10 to 40 million per transaction.

We can act as sole underwriter if needed, and guarantees can be provided up to 100% of target proceeds.

We do not provide bridge loans or convertible loans, nor do we act as a pre-subscriber, but we may recommend such pre-subscriptions to our backers and collaborators.

How we work

The process of setting up the underwriting of a rights issue is typically time critical. We are committed to working fast and to be transparent about our decisions. We have the setup and the resources to look at, and participate in, multiple transaction at the same time.

We base our decision on discussions with the senior management of the issuing company and their financial advisors. We may also engage with the company’s main shareholders, presubscribers, and other underwriters.

What we look for

Through these discussions we form an opinion on three key aspects

IS THE RIGHTS ISSUE WELL STRUCTURED?

Transaction structure is crucial, especially when there are several competing rights issues going on at the same time. Structure includes, among other things, the level of support from management and existing shareholders, the size of the discount to TERP, the degree of dilution, the terms of associated warrants (in a Unit transaction), whether the transaction is marketed in more than one country, and the choice of distribution channels.

THE QUALITY OF THE BUSINESS AND ITS LEADERSHIP

The small and midcap segments of Spotlight and Nasdaq First North are populated with growth companies whose quality as investments are not necessarily reflected in their financial statements. This applies not least to the biotech and IT companies. It is crucial that we can relate to the underlying investment case.

THE COMPANY’S INVESTOR RELATIONS EFFORTS

Companies that work professionally (which usually means intensively) with Investor Relations have more shareholders, as well as more trading in, and more correct pricing of, their shares. These companies often find it easier to raise capital.

Statistics on Nasdaq First North Growth Market and Spotlight Stock Market

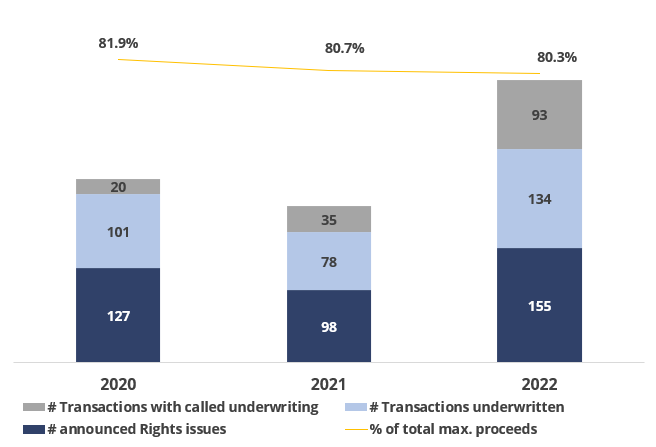

There were 152 rights issues on Spotlight and the Nasdaq First North Growth Market in Sweden and Denmark in 2022. The vast majority took place in Sweden. The companies raised just over SEK 7 billion (DKK 4.5 billion) in total.

134 of these rights issues (86%) involved underwriting. The total guarantees provided by the underwriters in 2022 was SEK 4.7 billion (DKK 3 billion).

Why do companies secure

their rights issues?

When a rights issue is secured – through presubscriptions and underwriting – the issuing company and the investors both know that the financing round regardless of the appetite in the market will bring the company new capital. This certainty provides important advantages

New investors are typically reluctant if they believe there is a risk the fundraising will fail to bring the company the financing it needs. Guarantees increase the likelihood that the fundraising will in fact be successful.

No company management wants to launch a failed capital raise. In addition to wasted time and cost, this always means the next financing attempt will be even more difficult.

With an appropriate guarantee in place the company does need unattractive “what-if” scenarios in the prospectus that steal attention from the growth story the company would rather tell.